Have a look at TGIF's recent data.

About Us

What Is Impact Investing?

Simply stated, impact investing is defined as investing with the specific objective of achieving both a competitive financial return and positive, measurable economic, social and/or environmental impact.

More broadly, impact investing is an emerging asset class that has captured the attention of some of the most sophisticated money managers in the world, who understand the power of mobilizing private capital to help solve some of the world's biggest social and economic challenges. JP Morgan Global Research reports that impact investing is expected to constitute 5% to 10% of investor portfolios within 10 years.1 Further, according to the U.S. State Department, this emerging class of investors is generating business opportunities that analysts estimate could reach between $500 billion and several trillion dollars over the next decade.2

"By 2025, annual consumption in emerging markets will reach $30 trillion—the biggest growth opportunity in the history of capitalism."4

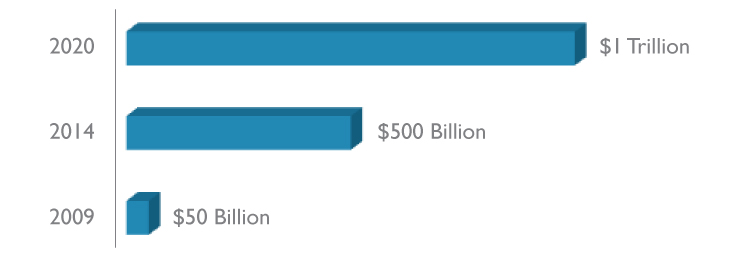

PROJECTED GROWTH OF IMPACT INVESTMENTS3

TGIF's Investment Portfolio

1Insight into the Impact Investment Market, JP Morgan, December 2011

2U.S. State Department, 2012 - The Secretary's Global Impact Economy Forum

3Latin America Private Equity & Venture Capital Association, Global Impact Investing Network and J.P. Morgan, May 2012

4McKinsey & Company, Winning the $30 Trillion Decathlon, 2012