The SME Opportunity

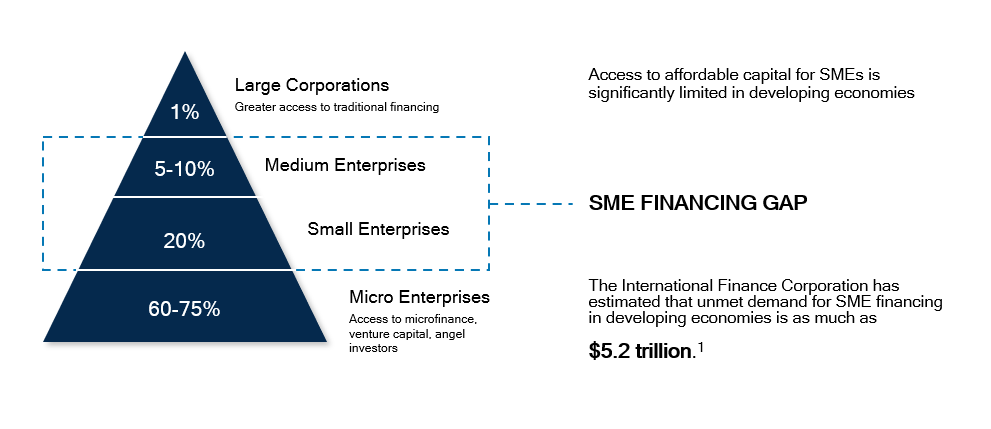

TriLinc Global Impact Fund provides growth stage loans and trade finance to established small and medium sized enterprises in select markets where access to affordable capital is significantly limited. This shortage of capital helps create a meaningful opportunity to generate competitive risk-adjusted returns by supplying funds to growing companies with experienced management teams and stable, positive cash flows.

- SMEs are generally considered the economic engines of developed economies, creating over 50% of GDP and approximately 70% of new jobs.2

- Globally, two out of three small businesses don't have access to sufficient financing, leaving millions of creditworthy businesses without the necessary capital for future growth.2

- Banks in developing economies report lower default rates for their SME portfolios than banks in developed economies, yet realize average interest rates that are at least 6% higher than the developed economy average.3

1MSME FINANCE GAP: Assessment of the Shortfalls and Opportunities in Financing Micro, Small and Medium Enterprises in Emerging Markets - World Bank Group, SME Finance Forum and International Finance Corporation 2017

2Banking on SMEs: Driving Growth, Creating Jobs Global SME Finance Facility Progress Report – September 2022, International Finance Corporation, World Bank Group

3Improving Access to Financing for SMEs Opportunities through Credit Reporting, Secured Lending and Insolvency Practices May, 2018 – Doing Business.Org, Doing Business Unit, Global Indicators Group